Saturday, May 20, 2023

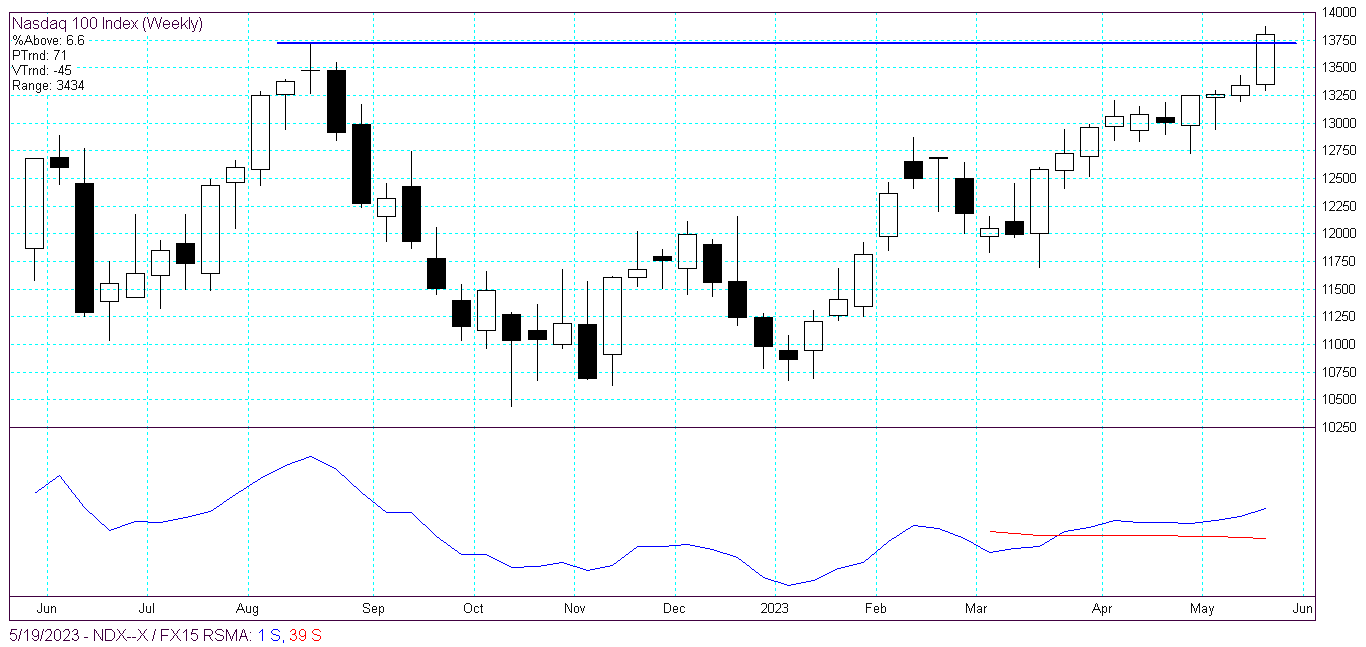

Nasdaq 100 Index (NDX) update

Wednesday, May 10, 2023

Anheuser-Busch (BUD) versus the beer industry and the stock market

Anheuser-Busch (BUD) compared to the beer industry and the stock market

There are five major "Brewery" stocks listed on the US stock market. The 5 companies, according to The Global Industry Classification System (GICS), are listed alphabetically as follows:

| Symbol | Company Name |

|---|---|

| ABEV | AMBEV S.A |

| BUD | Anheuser-Busch In Bev SA/NV |

| SAM | Boston Beer Company Inc. |

| CCU | Compañía de las Cervecerías Unidas SA |

| TAP | Molson Coors Beverage Co |

| Symbol | Company Name | 200 day % above/below |

|---|---|---|

| CCU | Compania Cervecerias Uni | 17.1 |

| TAP | Molson Coors Brewing Co | 10.1 |

| BUD | Anheuser-Busch InBev | 0 |

| QQQ | Nasdaq 100 Index ETF | -1.1 |

| SPY | SPDRs S&P 500 ETF | -6.3 |

| ABEV | Ambev S.A. | -8.5 |

| SAM | Boston Beer Co | -20.7 |

Thursday, April 13, 2023

S&P 500 Index $SPX update

Monday, April 3, 2023

Nasdaq 100 Index price reversals

Nasdaq 100 Index price reversals

Today intraday, the (NDX) is trading at $13,116. The immediate price reversal level to watch is $12,978. Trading above that level will help indicate the directional trend going forward. This is trend following, not forecasting or predicting. Stock chart below, comments welcome:

|

| Nasdaq 100 Index (NDX) |

Monday, March 20, 2023

The Semiconductor Index $SOX (SOX) price level

The Semiconductor Index $SOX (SOX) price level

|

| Semiconductor Index $SOX |

Monday, March 13, 2023

Gold ETF (GLD) overhead reversal

Friday, March 3, 2023

Dow Jones Industrials Index (DJI) headed back up

Dow Jones Industrials Index (DJI) next reversal area

The Dow Jones 30 Index $DJI (DJI) sell off stopped, reversed and is headed back up. The stock index has been oscillating in a range for many weeks. The next significant, long term, reversal area is at $33,357. A close over that, will provide a clue as to the strength and direction of the rally. Stock chart below, comments welcome:

|

| Dow Jones 30 Index (DJI) |

Thursday, March 2, 2023

Pfizer Inc. (PFE) stock update

Pfizer Inc. (PFE) stock update

On our last Pfizer Inc. $PFE post, on January 28th, the stock was trading at $43.79. We indicated "There is a long term monthly pivot at $41.87."

The selloff continues. As of today the stock is trading at $40.00, breaking the reversal. This indicates further downside trading. Updated stock chart (monthly) below, comments welcome:

Saturday, February 25, 2023

Pfizer Inc. (PFE) stock analysis

Pfizer Inc. (PFE) stock analysis

Fridays close was $41.75. The next major price Reversal area, below is $41.15. We'll see how the stock handles that price, on a weekly or monthly close.

Stock chart below, comments welcome:

|

| Pfizer Inc. (PFE) |

Saturday, February 18, 2023

Dow Jones Industrials $DJI Stock index continues stalled

Dow Jones Industrials $DJI Stock index continues stalled

Saturday, February 11, 2023

Dow Jones Industrials stalled

Dow Jones Industrials $DJI stalled

This post is stock market trend following, not a prediction or forecast.

The Dow Jones Industrials Index $DJI January rally has stalled at the price level of $34,337. This is determined by numerous price reversals at this level, analyzing weekly data long term. Stock chart below, comments welcome.

|

| Dow Jones Industrials $DJI |

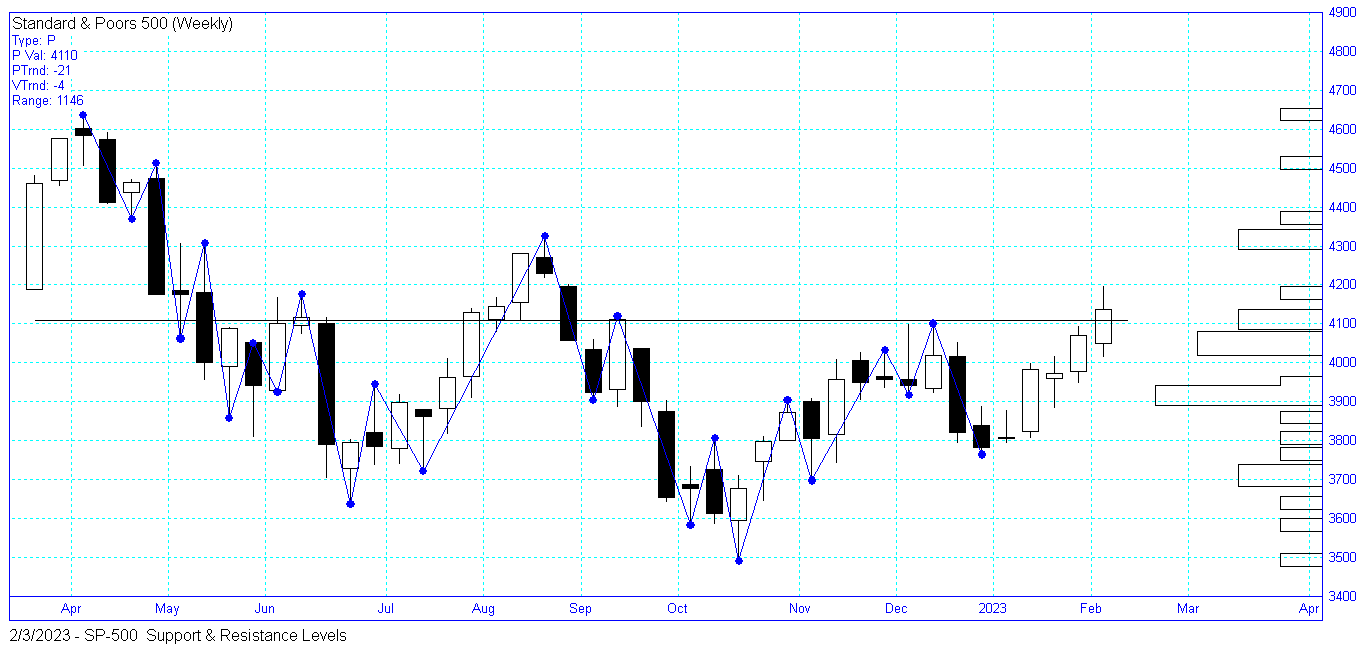

Sunday, February 5, 2023

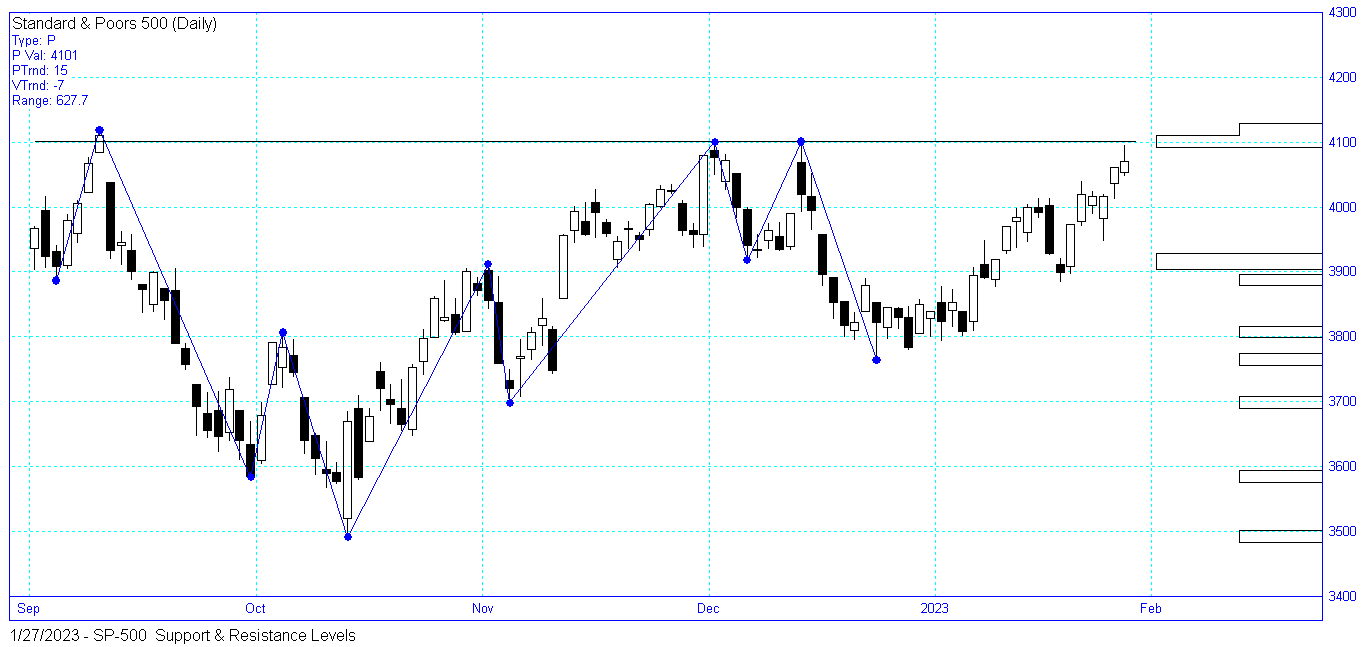

S&P 500 Index (SPX) rally continues

S&P 500 Index (SPX) rally continues

This is pure trend following. This is objective price analysis, not subjective. As freaky as domestic chaos may be, it may be more freaky elsewhere. You'll notice some of the loudest blogger bears' personal opinions out there, never mention global capital flow, as if that doesn't exist. Tip of the hat for gathering likes. Is the situation treacherous? Of course.

The rally off the October low remains intact, on a weekly and monthly basis. Weekly and monthly look backs filter out intraday and daily noise. Stock chart below, comments welcome:

|

| S&P 500 Index (SPX) |

Wednesday, February 1, 2023

The S&P 500 Index (SPX) and Nasdaq 100 Index (NDX) breakout

The S&P 500 Index (SPX) and Nasdaq 100 Index (NDX) breakout

Monday, January 30, 2023

S&P 500 Index (SPX) at resistance

Saturday, January 28, 2023

Pfizer Inc. (PFE) stock long term price pivot

Tuesday, January 24, 2023

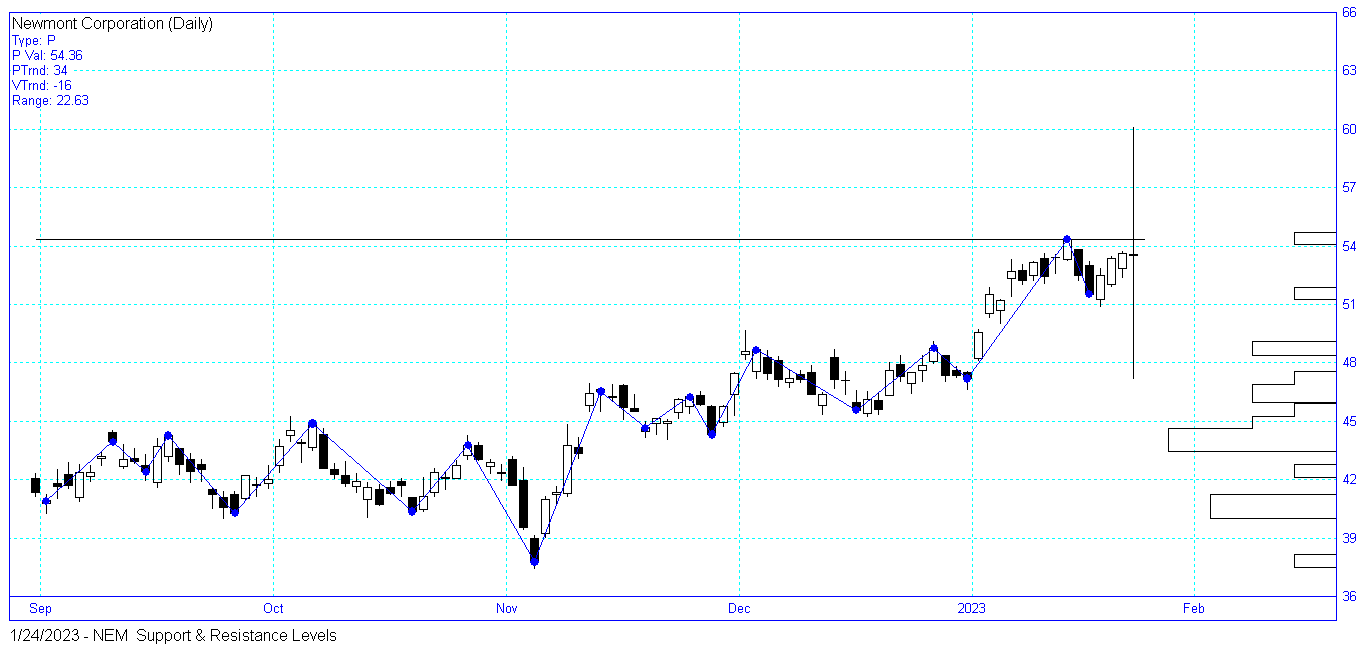

Newmont Mining (NEM) phat finger

Newmont Mining (NEM) freak trade

Saturday, January 14, 2023

Gold, the S&P 500, and global capital flows

Gold, the S&P 500, and global capital flows

Gold is most often commented on in the context of inflation. Often, what you don' t hear are comments on other items that often outperform gold, in the context of inflation, such as energy, agriculture, real estate, overseas stocks, etc. The gold coin and bar dealers don't mention these other things. Gold is a better indication of confidence. There was more confidence in the "system" last year vs. this year. The tide has turned. As to why confidence has shifted, is a big fundamental question. If the answer is as simple as money printing, the picture today would be entirely different.At the moment, gold, overseas stock markets, and a 15% annualized return (or a 15% RRR - Real rate of Return) are outperforming the S&P 500 Index.

From the perspective of US Listed ETFs, in US Dollars, the relative strength comparisons, using a 100 day simple moving average, gold, ex USA stocks, and "inflation" (RRR) are outperforming. This is a shift from recent history. 15% Inflation, taxes, and other expenses, is a modest benchmark. Food and energy prices, year over year, are way above the the 'CPI',

Following is a brief summary of these relative strength trend comparisons, vs. an annualized rate of return of 15%, over a 100 day moving average.

Current Trends % diff

Gold ETF (GLD) 7.9

China ETF (GXC) 14.5

Europe ETF (IEV) 12.0

S&P 500 Index ETF (SPY) 0.4