Gold, the S&P 500, and global capital flows

Gold is most often commented on in the context of inflation. Often, what you don' t hear are comments on other items that often outperform gold, in the context of inflation, such as energy, agriculture, real estate, overseas stocks, etc. The gold coin and bar dealers don't mention these other things. Gold is a better indication of confidence. There was more confidence in the "system" last year vs. this year. The tide has turned. As to why confidence has shifted, is a big fundamental question. If the answer is as simple as money printing, the picture today would be entirely different.

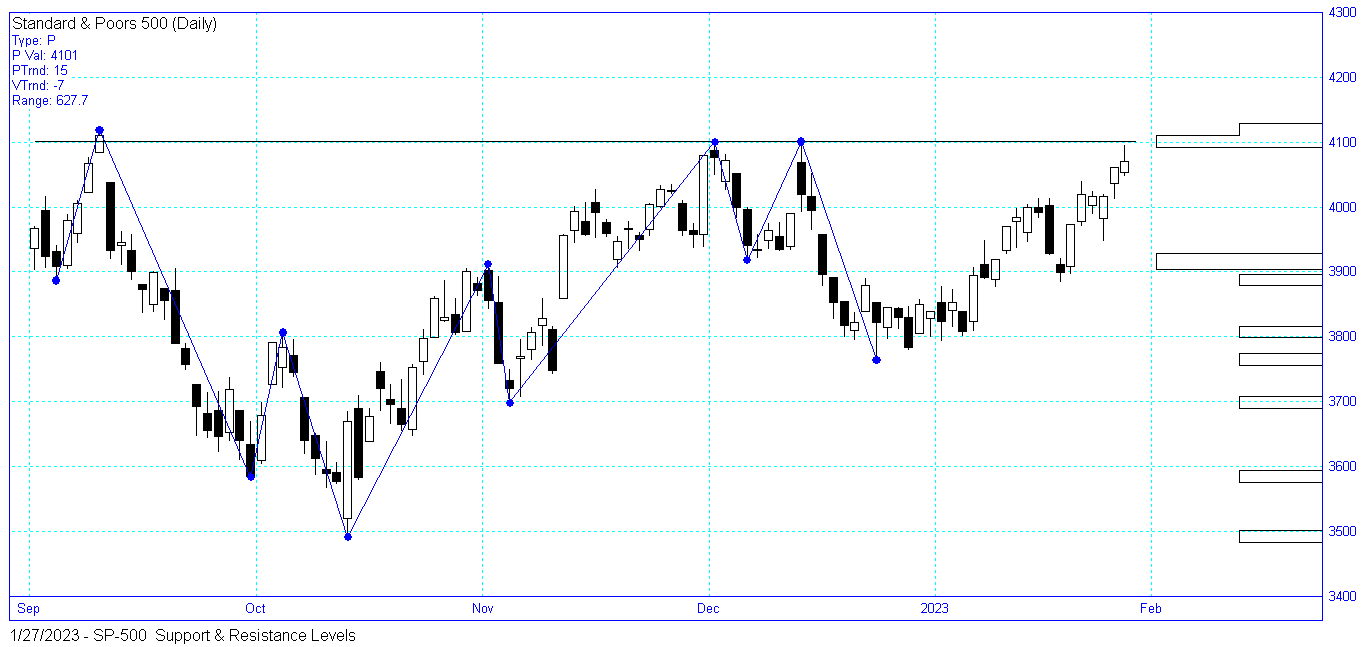

At the moment, gold, overseas stock markets, and a 15% annualized return (or a 15% RRR - Real rate of Return) are outperforming the S&P 500 Index.

From the perspective of US Listed ETFs, in US Dollars, the relative strength comparisons, using a 100 day simple moving average, gold, ex USA stocks, and "inflation" (RRR) are outperforming. This is a shift from recent history. 15% Inflation, taxes, and other expenses, is a modest benchmark. Food and energy prices, year over year, are way above the the 'CPI',

Following is a brief summary of these relative strength trend comparisons, vs. an

annualized rate of return of 15%, over a 100 day moving average.

Current Trends % diffGold ETF (GLD)

7.9

China ETF (GXC)

14.5

Europe ETF (IEV)

12.0

S&P 500 Index ETF (SPY)

0.4