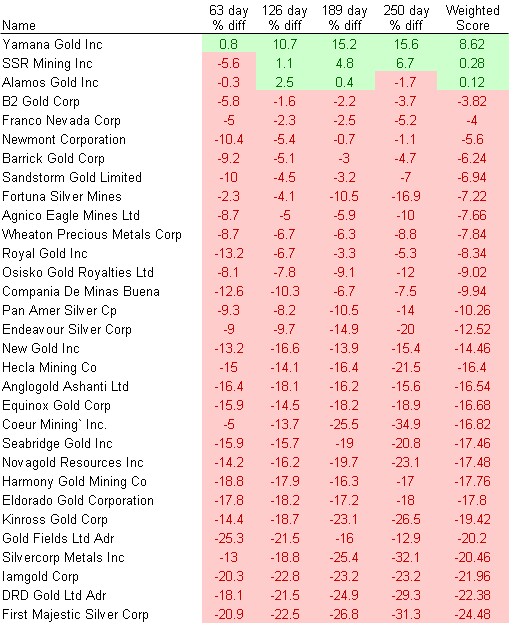

Gold Miner stocks watchlist

This post is trend following. This is not a forecast or prediction. There are no business fundamentals or economic fundamentals in this analysis.

All the gold and silver miner stocks on the list are currently on a trend following Buy signal. The signal occurs when the stock price goes from below the "Trend Quality" indicator zero line to above. Two ETFs, GDX and GDXJ, are included for comparison.

There are a total of 66 US Listed precious metals stocks. The number of stocks on Buy signal, as of 11/08/2022, is 25. The list is sorted by Watch % gain.

| Name | Symbol | Date Added | Last | Watch Start | Watch % | Watch Days |

|---|

| Coeur Mining, Inc. | CDE | 09/29/22 | 4.32 | 3.41 | 26.83 | 40 |

| Harmony Gold Mining Co | HMY | 10/03/22 | 3.24 | 2.58 | 25.39 | 36 |

| IAMGOLD Corporation | IAG | 10/21/22 | 1.67 | 1.38 | 21.36 | 18 |

| Alamos Gold Inc. | AGI | 10/25/22 | 8.51 | 7.75 | 9.81 | 14 |

| Newmont Corporation | NEM | 11/04/22 | 44.75 | 40.99 | 9.17 | 4 |

| Fortuna Silver Mines Inc. | FSM | 11/07/22 | 3.22 | 2.96 | 8.78 | 1 |

| Agnico Eagle Mines Limited | AEM | 11/07/22 | 46.45 | 43.08 | 7.82 | 1 |

| NovaGold Resources Inc. | NG | 11/04/22 | 5.24 | 4.87 | 7.6 | 4 |

| AngloGold Ashanti Limited | AU | 11/07/22 | 15.96 | 14.87 | 7.36 | 1 |

| First Majestic Silver Corp. | AG | 11/04/22 | 9.58 | 8.96 | 6.86 | 4 |

| VanEck Gold Miners ETF | GDX | 11/07/22 | 26.86 | 25.15 | 6.78 | 1 |

| Comp Buenaventura | BVN | 11/04/22 | 7.84 | 7.37 | 6.31 | 4 |

| Kinross Gold Corporation | KGC | 11/07/22 | 4.13 | 3.89 | 6.17 | 1 |

| Endeavour Silver Corp. | EXK | 11/04/22 | 3.83 | 3.62 | 5.8 | 4 |

| VanEck Junior Gold Miners ETF | GDXJ | 11/07/22 | 33.22 | 31.46 | 5.59 | 1 |

| Hycroft Mining Holding Corp | HYMC | 11/04/22 | 0.78 | 0.74 | 5.41 | 4 |

| Hecla Mining Company | HL | 11/07/22 | 5.04 | 4.79 | 5.11 | 1 |

| Wheaton Precious Metals Corp. | WPM | 11/08/22 | 35.77 | 35.77 | 0 | 0 |

| Silvercorp Metals Inc. | SVM | 11/08/22 | 2.74 | 2.74 | 0 | 0 |

| Sibanye Stillwater Limited | SBSW | 11/08/22 | 10.18 | 10.18 | 0 | 0 |

| New Gold Inc. | NGD | 11/08/22 | 1.06 | 1.06 | 0 | 0 |

| Barrick Gold Corporation | GOLD | 11/08/22 | 15.61 | 15.61 | 0 | 0 |

| Gold Fields Limited | GFI | 11/08/22 | 9.85 | 9.85 | 0 | 0 |

| Eldorado Gold Corporation | EGO | 11/08/22 | 6.7 | 6.7 | 0 | 0 |

| Yamana Gold Inc. | AUY | 11/08/22 | 5.04 | 5.04 | 0 | 0 |